In an era of increasing digital threats and regulatory scrutiny, banks face mounting pressure to demonstrate robust cyber resilience. Regulations

Application Mapping, Compliance Support, Industry-Standard APIs

Our BIAN training and services offerings support the full BIAN adoption journey with workshops, certification training, design assistance, and architectural guidance that enables effective implementation.

Whether you're just curious, ready to put a toe in the water, or ready to make a serious start, we can help you navigate the forks in the road with confidence.

As banks explore how to refactor traditional, monolithic IT into agile components, the BIAN model offers a standards-based template supported by the largest global institutions.

With our global BIAN services partners, we work with banks in Europe, Africa, Australia, East Asia, the USA and Canada. We have the experience and detailed knowledge to help you leverage BIAN into real business value.

Here are four examples from our real-world experience.

Working with a major European bank, we mapped hundreds of their applications to a capability model based on three service domain models:

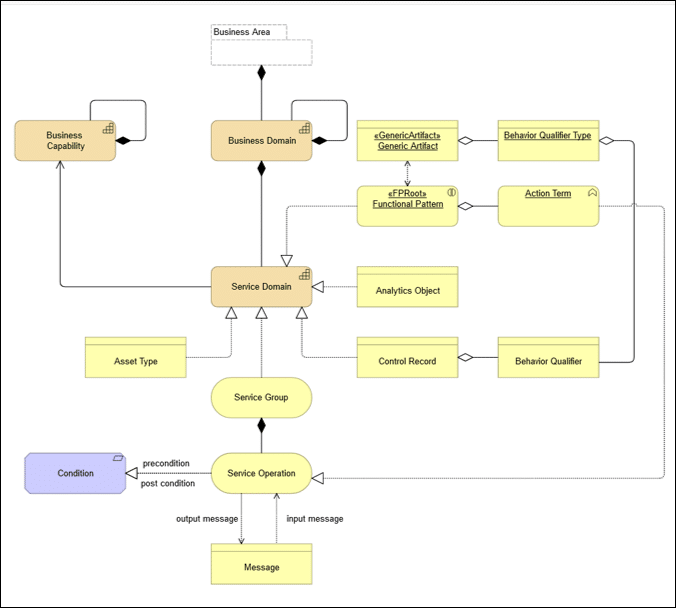

BIAN Service Domain metamodel

Mapping these Service Model-to-Application relationships into a standard Enterprise Architecture tool helps the bank understand and manage duplicate and missing business and technology functions. It is easier to anticipate and manage End of Life for vendor-provided applications and technologies.

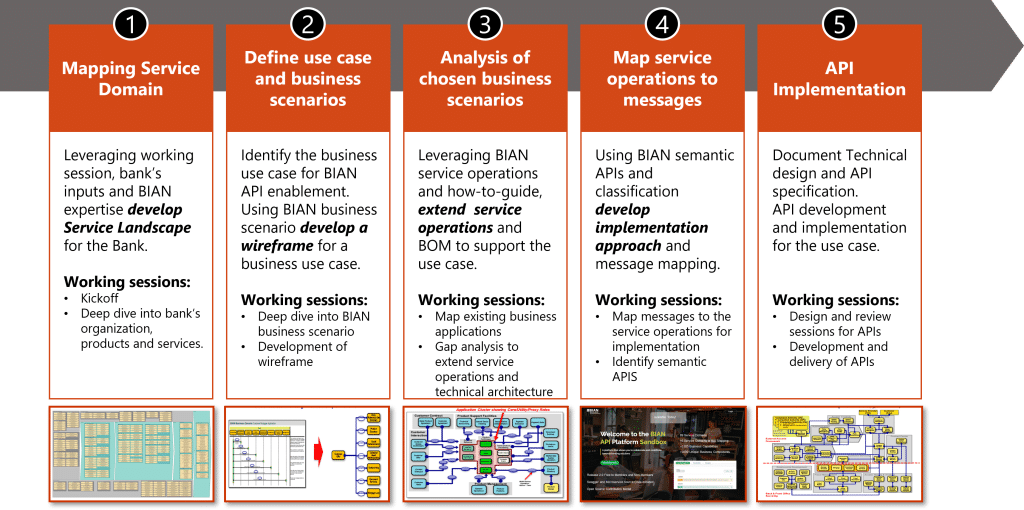

A key BIAN use case is creation of APIs that can enable flexible re-use in scenarios such as Open Banking compliance and embedded finance.

Many banks need to create reliable APIs:

BIAN's Semantic APIs can be used to build new API assets that are compliant with ISO 20022 and other standards. Building a new API landscape using a coherent model like the BIAN landscape helps banks to keep control of complexity.

BIAN APIs, based on industry standards, can be reused without the need to boil the ocean in testing. There are key decisions to be made on this path. We can help you to choose wisely.

Many banks want to understand how to turn their data assets into data products. Developing a stronger understand of these assets can lead to significant revenue growth.

Better understanding of data also enables better data governance, which supports many business and compliance objectives. Forrester Research reported in in 2022 that: "advanced insights-driven businesses (IDBs) are 8.5 times more likely than beginners to report at least 20% revenue growth."

BIAN offers a well-architected way to understand, structure and govern banking data assets. BIAN data is defined in the context of granular business services that can be exposed as APIs. This is a good basis for getting control of - and benefiting from - your data assets.

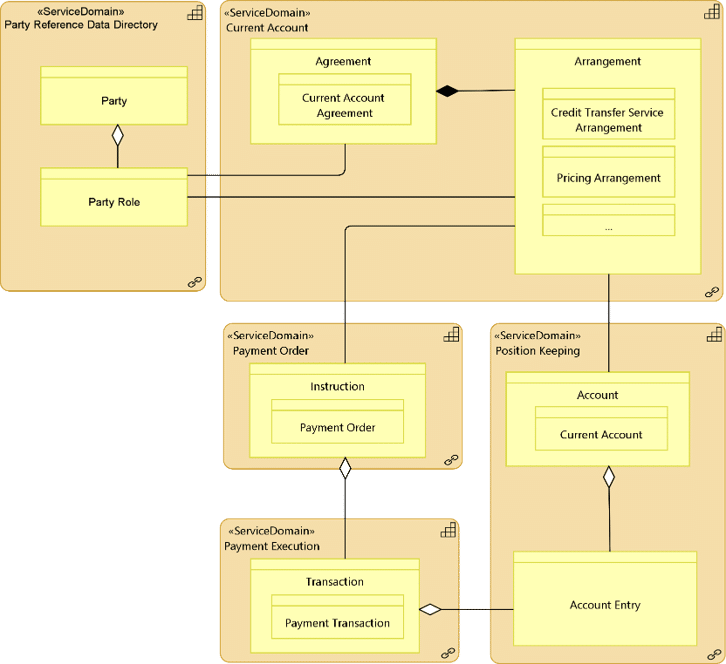

BIAN business object model

As adoption of new information paradigms like IT4IT and BIAN takes hold, legacy operating models will begin to shift, aligning with these new ways of thinking about information based services.

Some banks are anticipating this by using the BIAN model to inform significant business changes. We are already helping a large Texas bank with this journey.

The BIAN model reflects more than a decade of research supported by the world's largest banks and technology companies. there is good reason to believe that its underlying implication about business models is a robust way forward.

Contact us today to discuss your needs, and whether our BIAN Services might be part of the solution.